IO vs P&I repayments for Investment property

In this article, we’ll discuss the pros and cons of IO vs P&I repayment option.

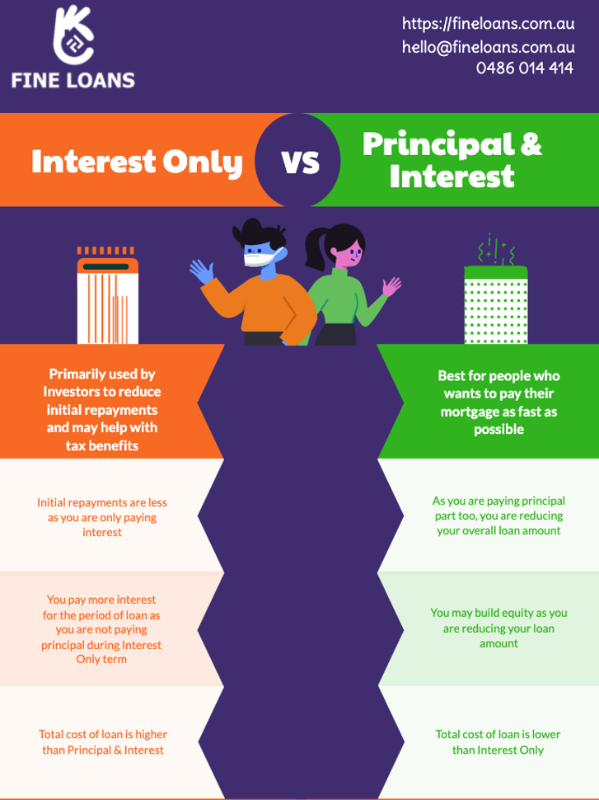

Investing in property is a popular way to build wealth and secure financial stability. However, choosing the right type of home loan can be challenging. Two common types of loan repayments for investment properties are interest-only (IO) and principal and interest (P&I). In this article, we’ll discuss the pros and cons of each repayment option.

Interest-only (IO) Repayments

As the name suggests, an IO loan allows you to pay only the interest on the loan for a set period, usually between 1 to 5 years. During this period, you won’t be paying off any of the principal amount. After the IO period ends, your repayments will switch to P&I, and you’ll start paying off the principal amount along with the interest.

Pros:

- Lower initial repayments: Because you’re only paying the interest during the IO period, your repayments will be lower than P&I repayments, allowing you to maximize cash flow.

- Tax benefits: With an IO loan, the interest payments are tax-deductible, which can help lower your taxable income and reduce your overall tax bill.

Cons:

- No reduction in principal: During the IO period, you won’t be paying off any of the principal amount, which means your overall loan balance won’t be decreasing.

- Higher interest rate: IO loans generally have higher interest rates than P&I loans, which means you’ll be paying more in interest over the life of the loan.

Principal and Interest (P&I) Repayments

P&I repayments involve paying both the interest and principal amount on the loan. This means that each repayment is contributing to paying off the loan.

Pros:

- Build equity: Each repayment is reducing the principal amount, which means you’re building equity in the property.

- Lower overall interest payments: Because you’re paying off the principal amount, you’ll be paying less in interest over the life of the loan than with an IO loan.

Cons:

- Higher initial repayments: P&I repayments are higher than IO repayments, which can impact your cash flow, especially in the early stages of the investment.

- No immediate tax benefits: Unlike IO loans, the principal component of P&I repayments is not tax-deductible.

In conclusion, choosing between IO and P&I repayments on your investment property depends on your financial situation and investment goals. If you’re looking for lower initial repayments and immediate tax benefits, IO repayments may be the way to go. However, if you want to build equity in the property and pay less in interest over the long term, P&I repayments may be the better option. It’s crucial to seek advice from a financial advisor or mortgage broker to make an informed decision.